Award-winning PDF software

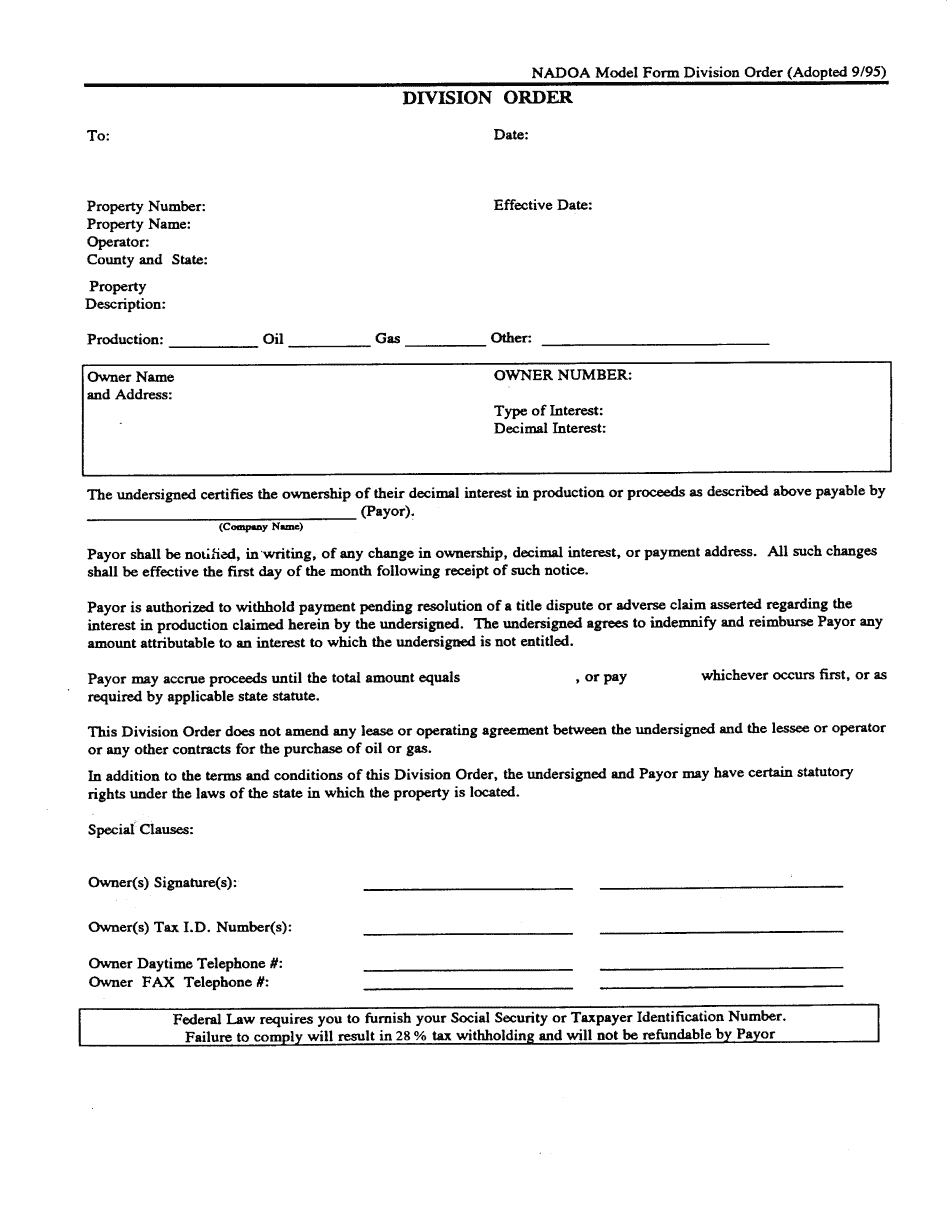

Transferring The Ownership Of Mineral Rights | A Quick Guide: What You Should Know

Identify the mineral rights that you want to transfer. This requires knowledge of your property's mineral rights and your family's personal property (property of the property that is not owned by the person with legal ownership. The person with legal ownership is usually the person who owns the mineral rights the first time the holder of these rights' dies.

Online alternatives help you to arrange your document management and supercharge the efficiency of your respective workflow. Go along with the short guide to be able to comprehensive Transferring the Ownership of Mineral Rights | A Quick Guide, prevent mistakes and furnish it in a very timely manner:

How to complete a Transferring the Ownership of Mineral Rights | A Quick Guide over the internet:

- On the website together with the type, simply click Launch Now and move to your editor.

- Use the clues to fill out the appropriate fields.

- Include your personal details and call information.

- Make confident that you enter accurate information and figures in ideal fields.

- Carefully check the information belonging to the form likewise as grammar and spelling.

- Refer to help section for those who have any issues or tackle our Help staff.

- Put an electronic signature on the Transferring the Ownership of Mineral Rights | A Quick Guide along with the aid of Signal Tool.

- Once the shape is concluded, push Accomplished.

- Distribute the prepared sort via e-mail or fax, print it out or help save on your own system.

PDF editor lets you to definitely make changes on your Transferring the Ownership of Mineral Rights | A Quick Guide from any online linked device, personalize it according to your requirements, sign it electronically and distribute in several means.