Mergers, acquisitions, and failures last year have seen a lot of mergers and acquisitions totaling around 2.4 trillion dollars. To give an idea of how much money this is, if you stack up two point four trillion dollars in $100 bills, it'll stretch from Washington DC to Denver. These mergers and acquisitions were done for various reasons, including tax avoidance in the U.S., crushing the competition, and complementing capabilities to grow. Let's talk about the third reason. The merger itself is a business decision, but what needs to follow is a plan on the mechanics of how the merger will happen. Functional areas have to be merged, business processes merged, people reallocated, IT systems made to work with one another, and so on, all while preserving the combined company's competitive advantage and leveraging their respective strengths. According to an HBR study, the failure rates of mergers and acquisitions are around 80 percent. In 2008, Bank of America was forced to rescue Merrill Lynch for forty-four billion dollars. But that was painful at best, with long-lasting implications, including the CEO of Bank of America at the time, Ken Lewis, losing his job. The cultural clash was one of the main problems. In 2004, Commerce One, a high-flying internet company, filed for bankruptcy after an acquisition failure. The company had many applications running on different platforms and technologies. Customers wanted to integrate across these applications, so Commerce One acquired a platform company. However, integrating with the platform was difficult to accomplish, leading to the company's demise. How you want to integrate the two businesses depends on your intent to improve your current business's effectiveness. You could dissolve the acquired company and fold its resources into the main business. Cisco's acquisition of WebEx in 2007 was a great success, while Chrysler's acquisition of Daimler in 1998...

Award-winning PDF software

Blm mergers and acquisitions Form: What You Should Know

The Post's Oil & Gas Journal: “In an unprecedented move, BLM approved a merger between three law firms in January.” Dec 14, 2024 — This blog post, published in January 2017, is a follow-up to a post by Oil & Gas Journal member Jeff Kline about acquisitions by the BLM. Overnight in the BLM — The Washington Post May 7, 2024 — In recent years, the BLM has entered into deals for a variety of oil, gas and minerals-related assets. Selling Off Its Lands — BLM Apr 13, 2024 — When they are acquired in real estate transactions, the BLM's National Operations Center (NOC) lists the properties that may be sold The Wyoming Oil and Gas Conservation Commission April 11, 2024 — The Federal Energy Regulatory Commission (FERC) approved the sale of rights to drill and frack within the BLM website Jan 16, 2024 — The BLM website provides a consolidated statement of its oil and gas holdings Mergers of the Big Green: How the Big Green Energy-Warlords Got Rich Sept 16, 2024 — A look into the history of “energy-wars” and how the oil and gas industry has been used to promote the same radical green agenda that is sweeping the U.S. Mining Law & the BLM May 16, 2024 — The BLM has its own page with useful links and information about its activities in regard to mining in the United States The BLM's National Operations Center (NOC) Jan 25, 2024 — BLM's National Operations Center (NOC) provides access to all BLM land properties. There are numerous public reports and forms which will assist property owners and users. Overnight in the BLM May 31, 2024 — An update about recent acquisitions, mergers, and transactions in government. The Federal Energy Regulatory Commission (FERC) May 9, 2024 — FERC approves approval of Uranium One bought by Russia's Rosa tom.

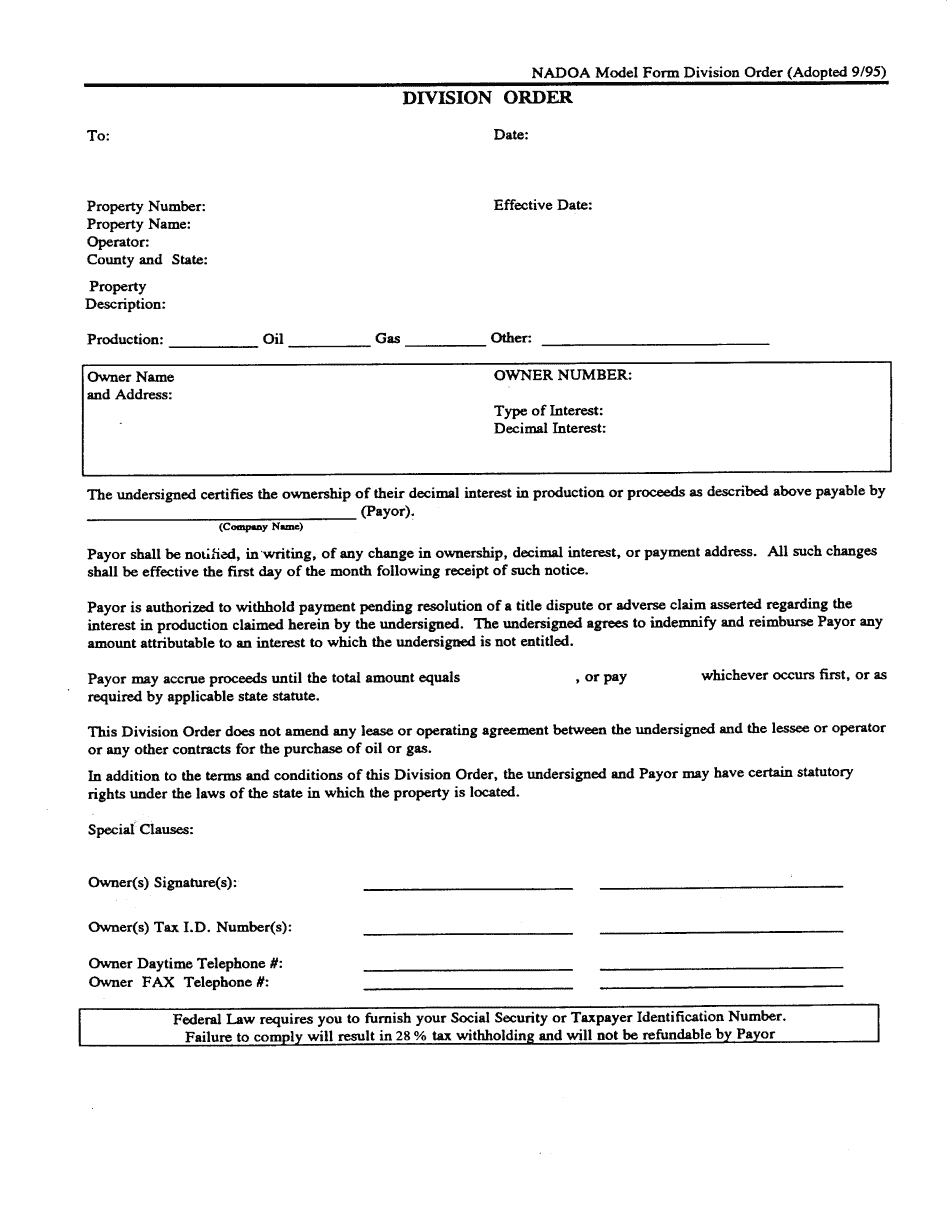

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Nadoa Model Form Division Order, steer clear of blunders along with furnish it in a timely manner:

How to complete any Nadoa Model Form Division Order online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Nadoa Model Form Division Order by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Nadoa Model Form Division Order from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Blm mergers and acquisitions