Hi everybody, I'm attorney Aiden Kramer with the law office of Aiden Kramer in Colorado. This is the most dramatic episode of All Up In Your Business yet! Just kidding, it's not dramatic. There's very little drama around here. However, we are going to be talking about contracts, and there can be some drama when it comes to contracts, in particular, one clause that's commonly put in contracts called indemnification. That's what I'm going to talk about today because I write a lot of contracts and I put an indemnification provision in pretty much every contract that I write. I find myself having to explain indemnification provisions to my clients a lot because it's a confusing term. It's not a common term that you hear every day, and the way U.S. lawyers write these indemnification clauses makes it even more confusing. So, maybe you've seen a contract. You had a contract written up for you, or you've signed a contract, and you see this word indemnification. What in the heck does that mean? In its simplest terms, indemnification means that one party will compensate the other party for loss or damage. If you're in a contract with another party, and they do something that causes you to have a lawsuit or some liability or damages, with an indemnification provision, it might require that party to pay for your legal expenses, pay for any losses or damages that you had because they were incurred as a result of what this other party did. Let's use my dogs, Rocky and Sue, as an example. Let's pretend my good buddy Rocky is operating a dog-walking business. Rocky loves to go on walks, and so he's taken other dogs with him. He's operating a business walking dogs. Let's say Sue is one of those...

Award-winning PDF software

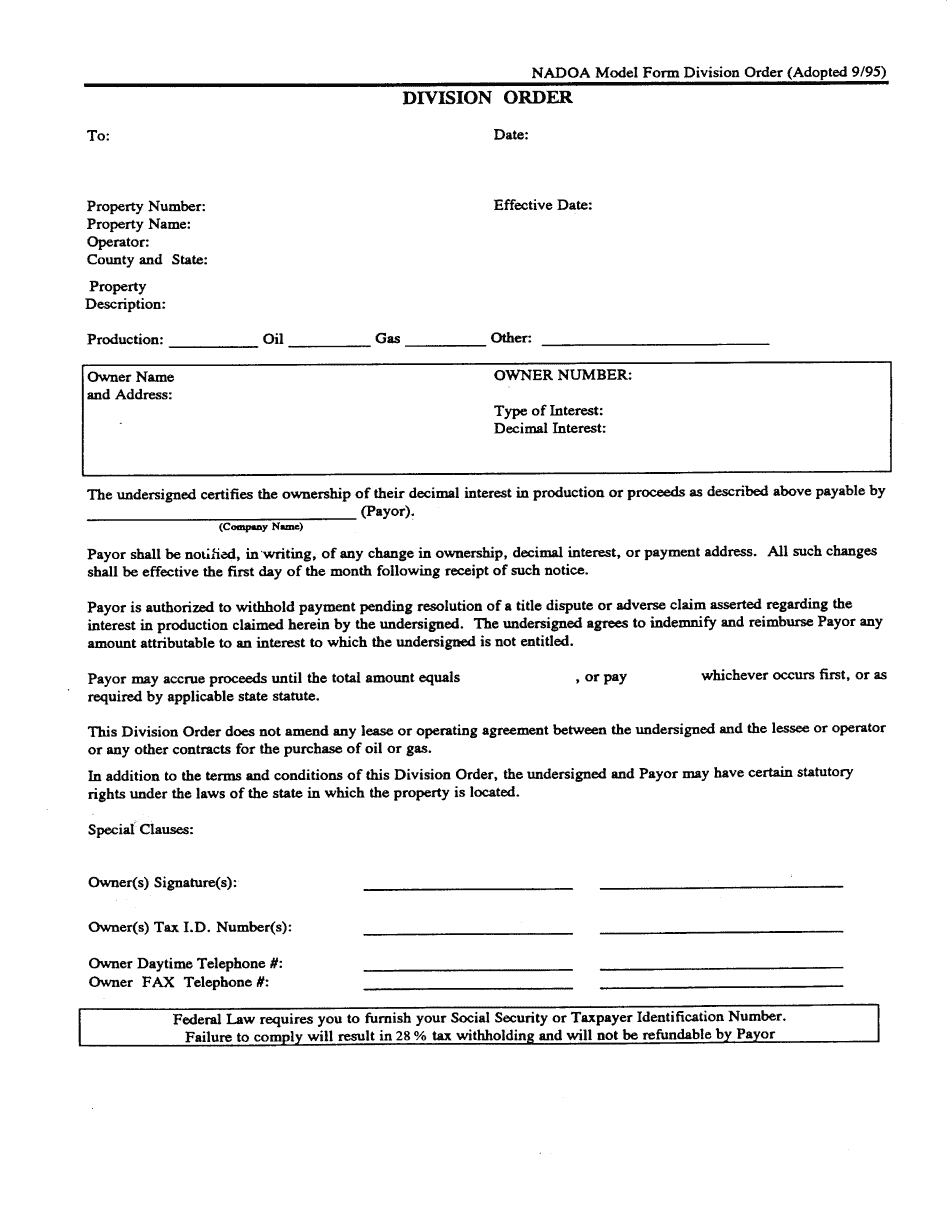

Indemnification Division Order Form: What You Should Know

The “distribution by sale or lease” may include all the foregoing. In the sale or lease of property, an entity that does not require a special exemption from the provisions of this section apply to any agreement that imposes an obligation on a person or group of people to 2. I have seen statements on the internet that state that any person or entity may impose a right of action on an owner or 3. I am not sure if this is a defense and indemnification agreement.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Nadoa Model Form Division Order, steer clear of blunders along with furnish it in a timely manner:

How to complete any Nadoa Model Form Division Order online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Nadoa Model Form Division Order by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Nadoa Model Form Division Order from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Indemnification Division Order