The last part of this video is about how a company called Paloma cheated me on a lease. They ripped up the lease, but still went ahead and filed it against my deed at the County Courthouse. So, in short, the video highlights their dishonesty and cheating behavior when it comes to leases and not paying what they owe. Now, let's discuss the issue of gas companies cheating on royalties. Take retired Pennsylvania dairy farmer, Don Foose, for example. He experienced a significant decline in his monthly gas royalty checks, from around eight thousand dollars to just a thousand. Chesapeake Energy, one of the gas companies, withheld almost ninety percent of his share citing mysterious gathering expenses. This, my friends, is what we call a royalty scam - a shameful act. Sadly, they don't limit their fraud to leases; it continues when they begin drilling and cheat you out of your royalties. Fortunately, the United States government has been able to take legal action against these companies and achieve success in suing them, thanks to their army of lawyers. However, for the little guys, like small-time landowners, it's an entirely different story. They have no recourse as lawyers often dismiss their cases for not being significant enough. It's an unfair situation, a shame, because the video highlights how gas companies trample on the rights of homeowners who lack the means to fight back. So, what am I trying to convey here? When dealing with the Texas oil people, expect to be cheated and lied to at every level. And even if you do get cheated, it's highly unlikely that you'll be able to find a lawyer who is willing to take on your case due to its small size. Therefore, I am seeking out all the small landowners who have...

Award-winning PDF software

Oil and gas royalties questions Form: What You Should Know

How to Calculate Your Oil & Gas Revenue February 9, 2024 — This article will help landowners calculate the amount of royalties due at the end of the lease term. In the example below, you would assume that the total gross __________ is 0. If you know the total gross __________ for How to Calculate Your Oil and Gas Bill Payment November 15, 2024 — To calculate your net income, you would first multiply gross revenue of 0 by the lease term of 20 years, and multiply gross revenue by the royalty rate of 20%. Frequently Asked Questions About Royalties — Royalty Rates How do I calculate my net income or gross income? If you know the total gross __________ for the lease, multiply it by the royalty rate for 20 years. The net __________ should be the same or less than your gross income. Calculate your royalty rates in the following tables: Oil & Gas: 1-gallon and barrel Oil and Gas: Barrel of oil and Gasoline, and Water How to Calculate Net Operating Income (NOI): Net income for operating revenue is the difference between gross revenue and gross profit multiplied by the gross profit margin divided by the gross profit. How do I calculate net operating income (NOI) for a lease? The following tables demonstrate the computation of net operating income (NOI) for leases. (Refer to table 1) Oil and Gas: Monthly Operating Expenses Net Operating Income (NOI) 1-gallon 5.50 Net Operating Income (NOI) 5-gallon 14.60 Net Operating Income (NOI) 1.5-gallon 23.90 Net Operating Income (NOI) 2-gallon 29.50 Net Operating Income (NOI) 4-gallon 42.40 Net Operating Income (NOI) 1-barrel 60.90 NOI from 1,000,000 1-barrel 160.20 NOI from 5,000,000 5-gallon 480.00 NOI from 9,000,000 1-barrel 600.00 NOI from 13,000,000 5-gallon 960.00 NOI from 19,000,000 1-barrel 1080.00 NOI from 24,000,000 5-gallon 1640.00 NOI from 35,000,000 1-barrel 1890.

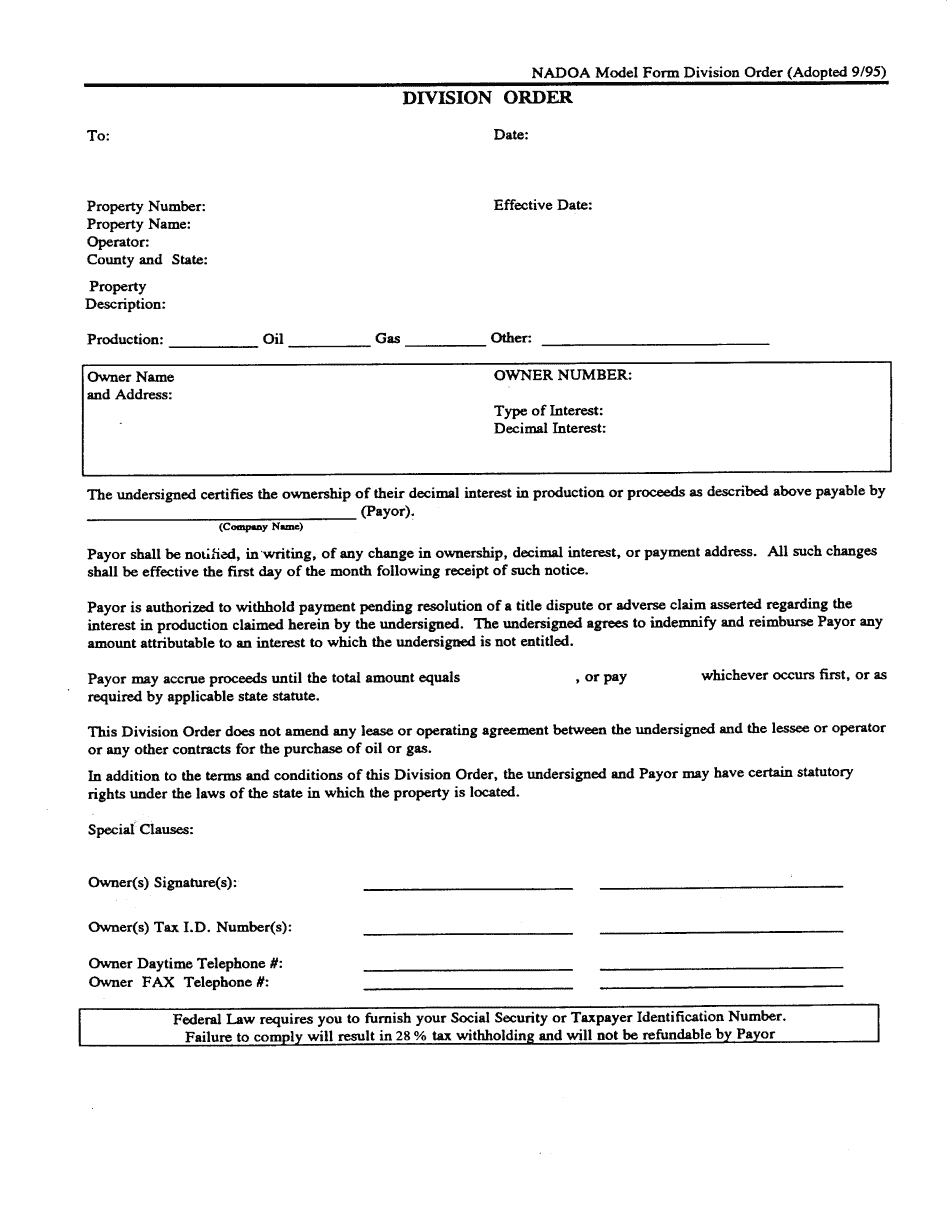

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Nadoa Model Form Division Order, steer clear of blunders along with furnish it in a timely manner:

How to complete any Nadoa Model Form Division Order online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Nadoa Model Form Division Order by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Nadoa Model Form Division Order from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Oil and gas royalties questions