Since 2004, the founders of Peregrine 1031 Energy Partners have been turning the idea of traditional real estate investment upside down. We think of traditional real estate as a piece of land with one or more buildings, such as an office complex or a shopping center. In traditional real estate investments, your profit depends on steady high occupancy rates by successful tenants who pay you rent over time. Properties need renovations and repairs, and tenants can be here today and gone tomorrow. As an investor, you look for smart ways to strengthen your investment portfolio. The diversification, protection from inflation, and a good return are a few important goals. Investment in real estate has always been an excellent choice, but there's much more to real estate than meets the eye. To tap into it, we need to look below the surface and think outside the brick and mortar. In the U.S., there are two types of land surface rights commonly known as real estate and subsurface rights commonly known as mineral or royalty rights. At Peregrine's, we focus exclusively on these mineral and royalty rights, specifically in areas where underground natural resources, including oil and natural gas, are abundant. Major oil companies like Exxon and Shell, who want to access oil and gas reserves, give a mineral owner the right to drill and operate oil wells on his or her property, along with an ongoing percentage of the revenue produced from that land. This revenue is called a royalty. Private royalty ownership has been around for over 150 years, but unless you were born into it, most of us have not had access to the mineral rights these lucky landowners have been passing down for generations. At Peregrine's, clients have the opportunity to step into the shoes of these landowners. Unlike oil and...

Award-winning PDF software

Oil and gas royalty payments Form: What You Should Know

The report shall include: (a) a description as to the volume of oil or gas, (b) the dates when the oil and gas were received or released (when available), (c) the date and state of payment, (d) the total number of barrels of oil and gas received or released, and (e) the amount of royalty payment; and (3) To recover the expenses incurred by the COLLECTION of royalties on Indian oil and gas and all geothermal leases, a report is made on FORM 3100-11, Bureau of Land Management Report of Sales and Royalty Remittance, if the Amount is equal to at least 3,000.00. Form 3100-11 includes an explanation of the report; and. (4) If the amount of royalty payments to a lessee is less than 3,000.00, a statement is required to be filed on Form 3100-11, Bureau of Land Management Report of Sales and Royalty Remittance with the appropriate information. The statement of oil and gas sales, the receipt or release dates, the name of the lessee, and the amount of royalty payments shall be included in the statement. (F) When a lease is not being produced for commercial purposes (such as a lease holding only natural gas), the purchasing party (owner or other person) shall make the initial royalty payment, and the lease shall be reported on Form ONRR-2014, Report of Sales and Royalty Remittance, as appropriate. (F) A deposit of ten dollars (10.00) shall be made by the person making payments to a mineral estate, and one hundred dollars (100.00) by the person collecting royalty payments, either in person, or electronically, to a mineral estate. (F) When a lease sale price or other form of royalty payment is required, the lease report must be recorded in the office of the appropriate agent; and a deposit of ten dollars (10.00) must be made, either (i) in person, or (ii) in electronic format, in advance, of any form of royalty payment to the lessee from the sale of the lease. A deposit of four and one-half percent (4.5 percent) (or 4.

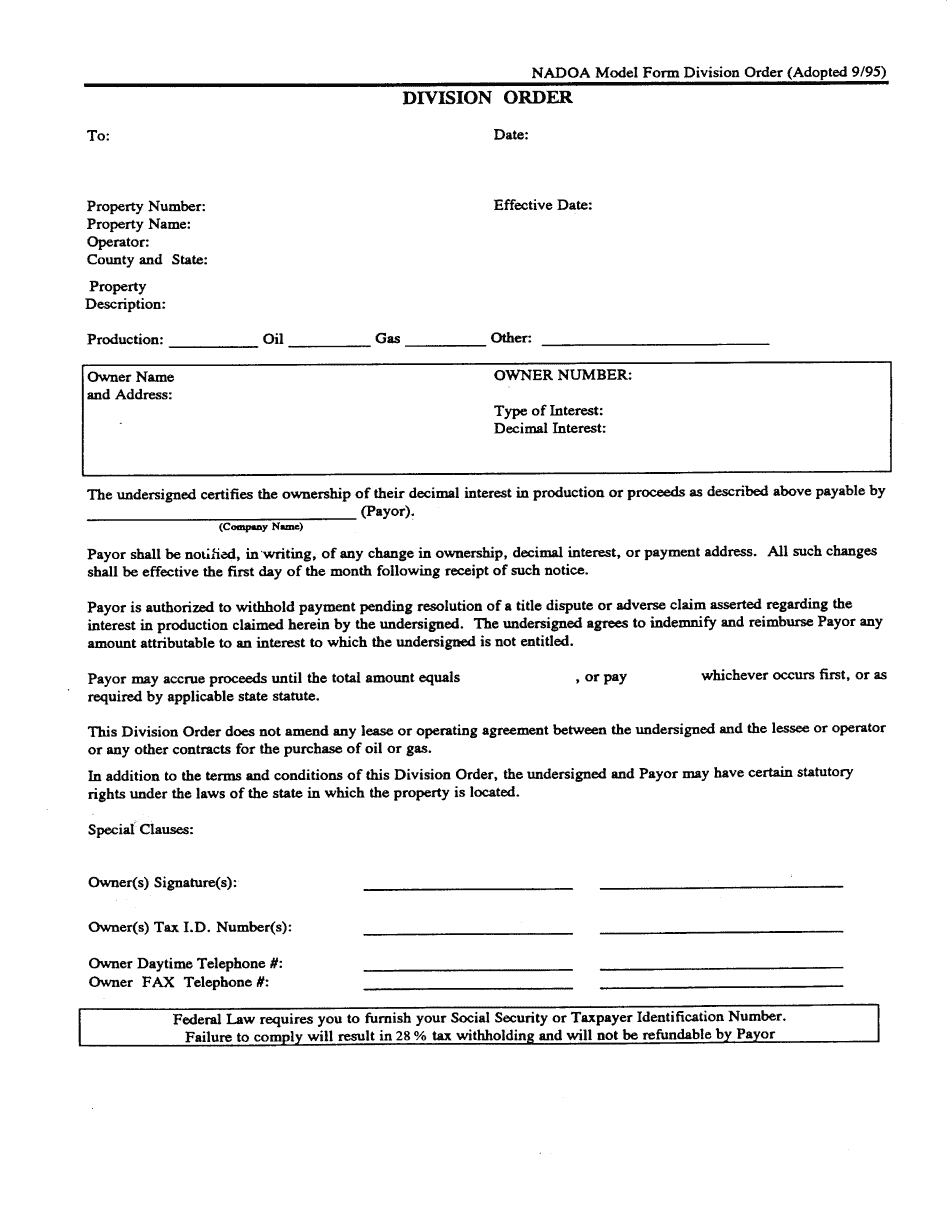

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Nadoa Model Form Division Order, steer clear of blunders along with furnish it in a timely manner:

How to complete any Nadoa Model Form Division Order online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Nadoa Model Form Division Order by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Nadoa Model Form Division Order from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Oil and gas royalty payments