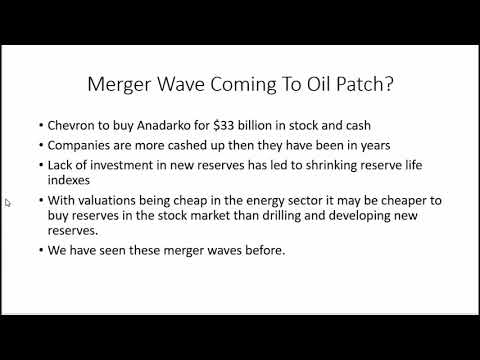

Hey guys, John Paula here. Today is Sunday, April 13, 2019, and as I look out my window here in Chicago, I see a lot of snow coming down in the middle of April. Quick comment, I'm going to talk about it more next week, but there's more and more data suggesting that the so-called warming that was supposed to happen isn't really happening. One of the arguments I've been making is that we are in for a long period of cooling on Earth, and this will have ramifications in energy and food production. Now, I'm not one of those people who panics and says we're going to have a new Ice Age, but even slight changes in temperature and weather can drastically affect agricultural production. The fact remains that one of my investment theses going forward is an increasing population with less arable land per person. So, if the great yields and growing conditions we've experienced over the last ten years or so start to go in the opposite direction and we have actual weather events that cause crop failures or lower production, this is going to be a problem and it's going to raise food prices. In addition, obviously, if it's colder, there will be an increase in energy consumption. I just think that we're looking at an overall shift in climate here, but not the way people think. I'll be talking about it more next week. Speaking of energy, as I mentioned, I like to follow certain people on Twitter and one of the people I follow is Eric Nuttall. He runs Nine Point Partners, a Canadian based energy investment firm. He recently posted a chart showing the free cash flow yields at certain oil prices and differential prices. The differential is the difference in price between West...

Award-winning PDF software

Oil and gas mergers Form: What You Should Know

Mergers and Acquisitions in the Oil and Gas Industry | World Bank Group We are a team of oil and gas professionals, with deep understanding, and experience in this industry. We will offer professional advice to clients seeking to engage in oil and gas mergers and acquisitions.

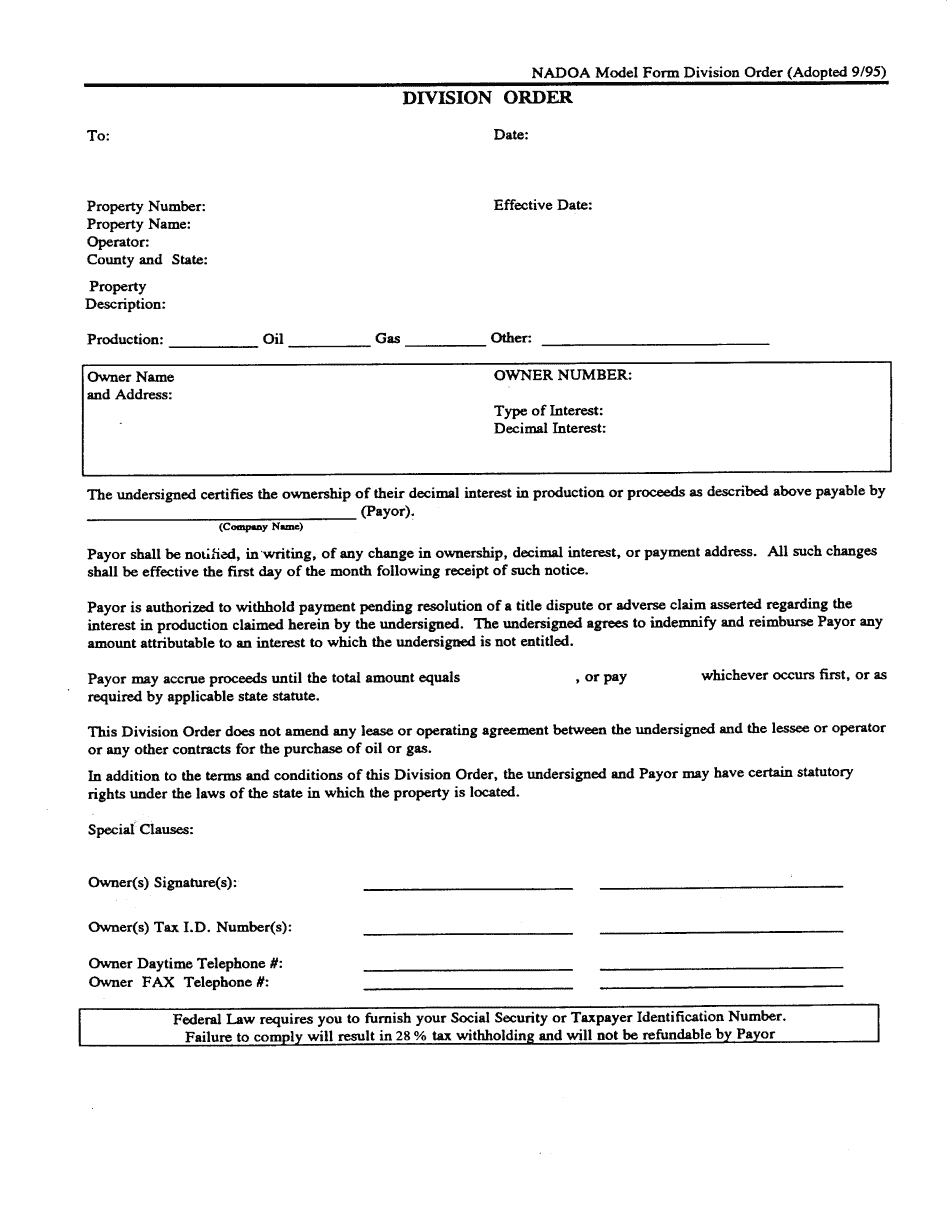

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Nadoa Model Form Division Order, steer clear of blunders along with furnish it in a timely manner:

How to complete any Nadoa Model Form Division Order online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Nadoa Model Form Division Order by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Nadoa Model Form Division Order from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Oil and gas mergers