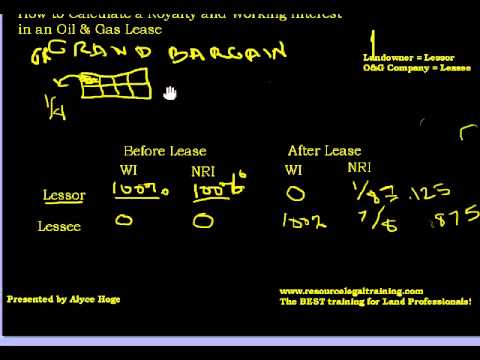

Okay, I want to walk us through how to calculate a royalty and working interest. This will be helpful if you are a royalty interest owner trying to figure out how oil and gas companies calculate decimals, or if you work for an oil and gas company and need a better understanding of how royalty and working interests are calculated. Let's start with some basic definitions. The landowner, also known as the lessor, is the person who owns the land. You may hear them referred to as the lessor, which rhymes with landowner. The oil and gas company is known as the lessee, and company rhymes with lessee. We will look at the royalty calculation and working interest calculation in an oil and gas lease before and after taking the lease. This depends on the royalty interest or fraction. Another term to understand is working interest. The working interest owner is the one responsible for expenses. The net revenue interest refers to the revenues. In order to understand a royalty calculation, you need to understand the basics of the grand bargain and the law. The grand bargain states that before an oil and gas lease, the lessor owns a 100% working interest and a 100% net revenue interest. So why would a lessor give an oil and gas company 100% of their working interest and keep only a small percentage of the revenue? The reason is that drilling an oil and gas well is expensive, often cost-prohibitive for most people. It can easily cost a million dollars or more, and expenses can increase with additional work. Landowners or royalty owners often agree to a 1/8 royalty, for example. This means the lessor currently owns 8/8 or 100%.

Award-winning PDF software

Deleted interest oil gas Form: What You Should Know

Filing Form 730: In order to make the deletion of Standard Exception 5 of the WIG, the borrower/seller must file and cause to be filed an affidavit in writing to show that the easement or claim of easement is Not shown in public records. DELETING STANDARD EXCEPTION | FEDERAL Standard Exception 6 : Easements or claims of easements not shown by public records. This may be deleted with a borrower/seller affidavit in a form Filing Form 730: In order to make the deletion of Standard Exception 6 of the WIG, the borrower/seller must file and cause to be filed an affidavit in writing not showing the easement or claim of easement. DELETING STANDARD EXCEPTION | FISCAL Standard Exception 7 : Unenforceable easements not shown in public records. This may be deleted with a borrower/seller affidavit in a form Filing Form 7 “Standard Exception” 7: Easements and Claims not shown in public records. This can sometimes be deleted as follows: a. In all the cases listed in Example 11. b. If the borrower/seller is willing to sign the form stating that easement or claim of easement is not shown on the WIG or Form 730. c. If any of the following easements or claims are subject to an express or implied trust or right of survivorship A. Easements or claims of easements shown on public records. B. Easements or claims not shown on the WIG or Form 730. See: Exceptions to Declaration of Non-Existence of Easements on Public Records under § 1. Filing Form 730. (1) To delete the applicable standard and/or special exceptions, the borrower/seller must first (a) Identify each standard exception and/or special exception that is not shown on the WIG or Form 730 by providing the following information: Example 11. Example. 11 Deleted exception number. (b) Complete and sign a Declaration of Non-Existence of Easements on Public Records. The Declaration must be on the filing sheet. Use this Declaration to identify each standard exception and/or special exception that is shown by a public record that is not shown on the WIG or on Form 730.

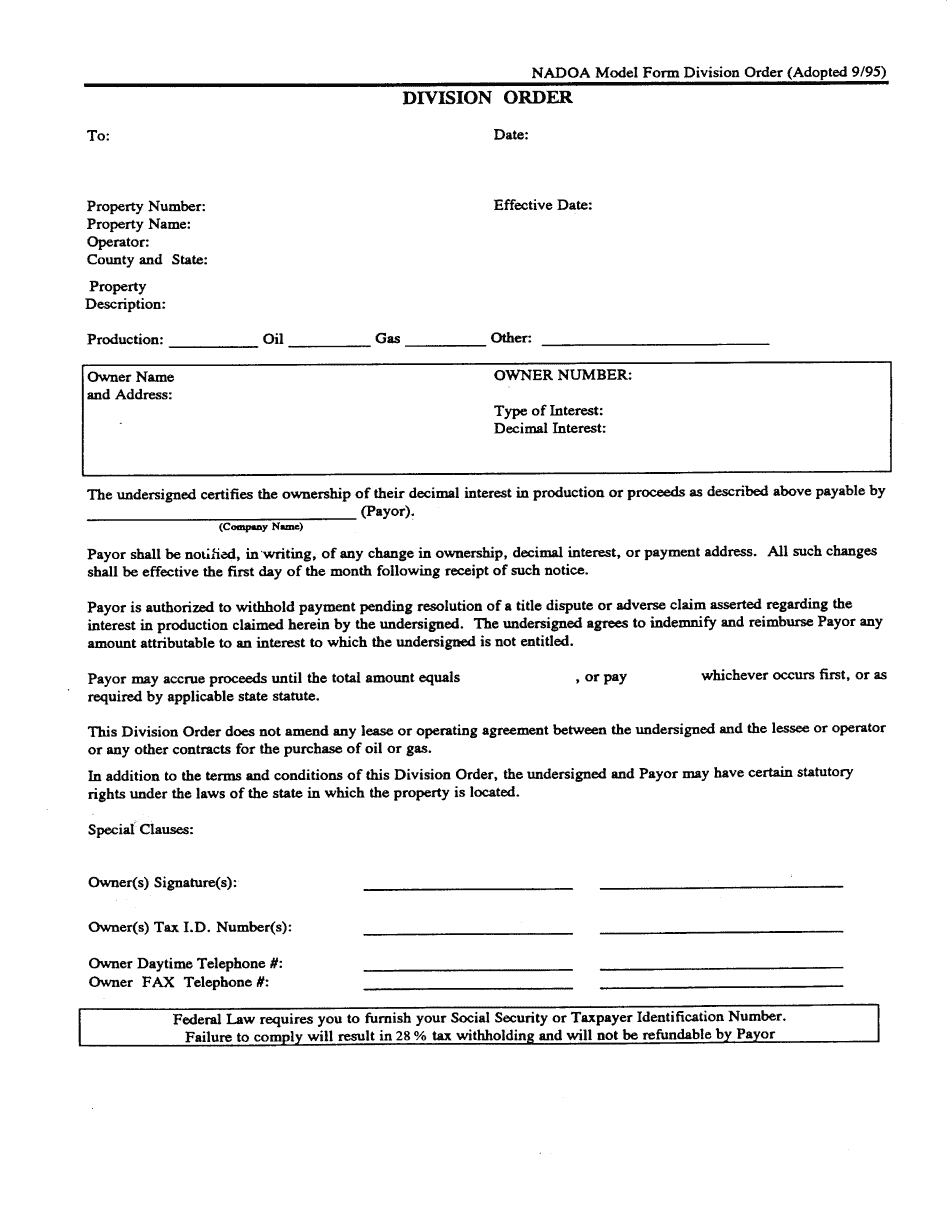

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Nadoa Model Form Division Order, steer clear of blunders along with furnish it in a timely manner:

How to complete any Nadoa Model Form Division Order online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Nadoa Model Form Division Order by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Nadoa Model Form Division Order from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Deleted interest oil gas