Award-winning PDF software

Inherited mineral rights Form: What You Should Know

Mineral Ownership in a Developing Country — International Resources International, Ltd. How to Own Mineral Rights in Canada Alberta Government Deposits How long before deposits are considered part of the reserve and have tax-free status? The general rule is 30 years. What are the tax implications? Deposits held in the Crown, are eligible for an automatic 30% tax-free, over and above the statutory 15% tax-free on mineral income. Do I need a royalty declaration? A freehold landowner or licensee requires an Annual Statement of Royalties to be filed with the Ministry to establish tax status. What constitutes a royalty? Royalties are an income-producing right for certain minerals. Royalties are not income for other commodities. How can I avoid paying tax on mineral rights? A freehold land licensee or landowner can avoid paying mineral royalty taxes if they have a separate contract in place that outlines royalty payments, either in the form of payments or advances. Can I still deduct the royalties from income? There are tax advantages to this. The freehold mineral owner does not pay royalties on the production of minerals as a resource, unlike a corporation that uses such minerals as income. He/she can deduct his/her royalty payments from income. What is a production tax credit? A production tax credit of up to 2.2 million per year is available for the initial stage of making a mineral lease (mining stage) or a deposit into a reserve. During this stage the mineral production is considered an income-producing asset and is subject to a percentage of income tax. The producer or mineral right owner can claim this on their gross income using the “Election to Claim the Production Tax Credit” in Form T1909. There are various factors that apply to the tax treatment of a production tax credit. These include the purpose of the production (resource development or exploration; or a deposit into a reserve) and the size of the production (0.3% or 25%) and the length of the production (30 or 100 years).

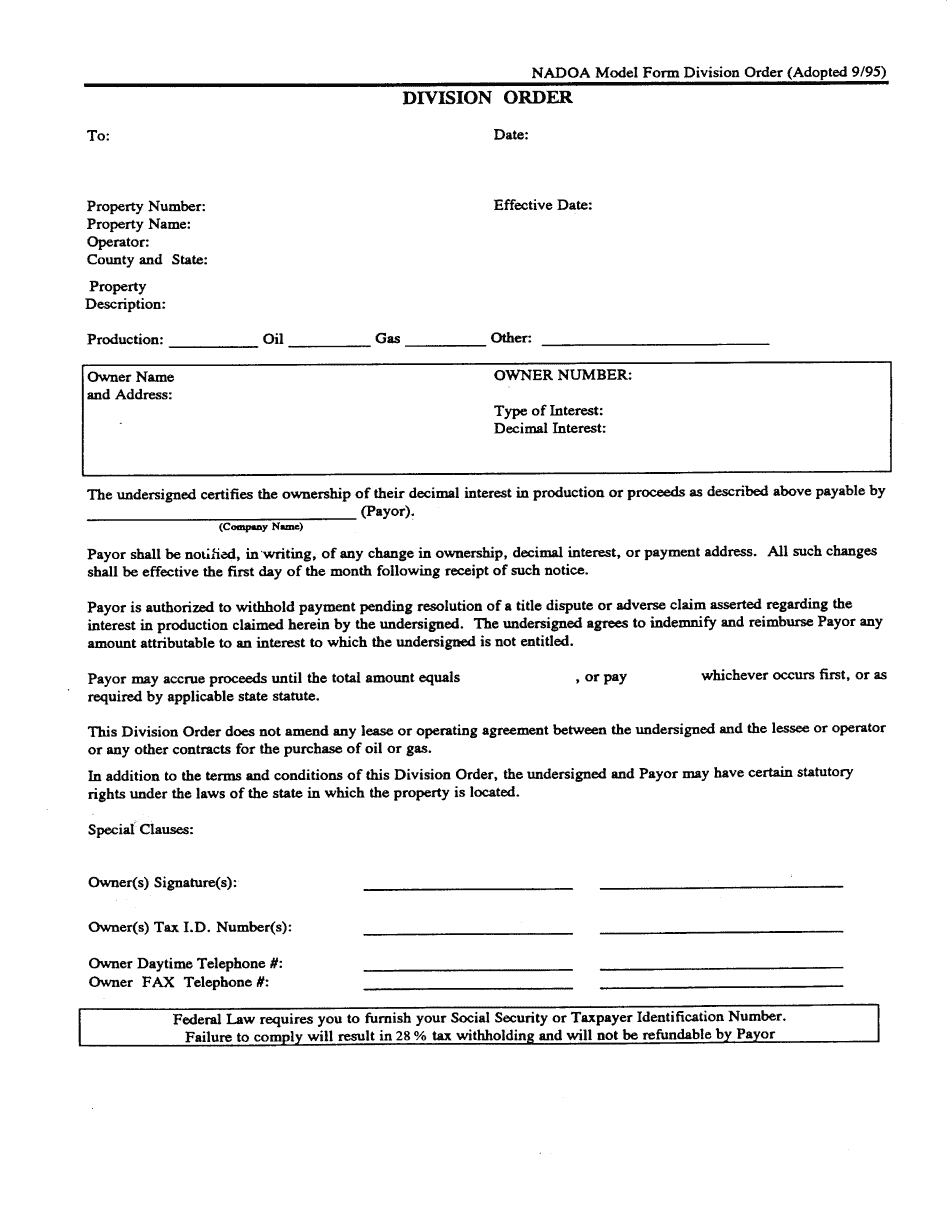

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Nadoa Model Form Division Order, steer clear of blunders along with furnish it in a timely manner:

How to complete any Nadoa Model Form Division Order online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Nadoa Model Form Division Order by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Nadoa Model Form Division Order from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.