Let's talk about oil and gas royalty statements. If you're just starting out, this can be a little bit confusing. But I think if we just go through this once, it'll become pretty clear that it's really easy to understand. So there are three parts to an oil and gas royalties statement. If you have the basic information of the operator and the well, and what it's located and who they are, and the name of the numbers city and county and everything, you also have the gross and net numbers related to how much the well produced and how much it made as a whole. And then you have your individual numbers, your owner's specific information. And this is where those numbers are multiplied by your decimal interest to show you exactly how much of the whole production is yours. The first section is the property. Now, this is the name of the well and you might have several wells in your statement or you might have just one. In this example, there's only one well. And you can see under property that there is an identification number, there's a name, and there's a well number. Like 2H is a second well that's drilled there and H stands for horizontal well. If you keep going across, you'll see the county and the state. In this example, we're looking at Young County, Texas. Production date is the date of production for that well in this statement. This statement shows two months' production because the ownership is very small and so the check is too small. It has to be $100 for this producer for them to send a check out. So it takes every like two months they'll say to check out. That's why you're seeing all of November and all...

Award-winning PDF software

Oil royalty inheritance Form: What You Should Know

G., through sale, sub-dividing from another firm, etc.) A Step-Up In Basis: The Basics Dec 21, 2024 — It's important to consider the steps involved in getting a Step-Up In Basis on your mineral rights. This can provide financial flexibility by reducing tax liabilities when your company receives royalties for non-producing properties or when you sell the rights to another company or sell the rights to your business through a partnership (that is a company formed to own the rights of others), a stock transfer or a stock purchase. The first time you want to Mineral Rights: A Primer Mar 22, 2024 — These days, many people are looking for ways to avoid getting into costly and protracted royalty disputes. You should know that it is a mistake to try to “beat the system” by buying up as many mineral properties as possible — when we do this we may be setting ourselves up for a big tax liability and potentially for a loss of valuable mineral rights. It is also not that simple to create a “fair” value on mineral rights as they need to be evaluated by qualified professionals, such as appraisers, as part of the appraisal process and the mineral rights need to be valued as part of the valuation. If you want to get into mineral ownership, and you do not have time to do it yourself, the best way to get started is to contact a seasoned professional with experience evaluating mineral land and rights and help establish a fair value.

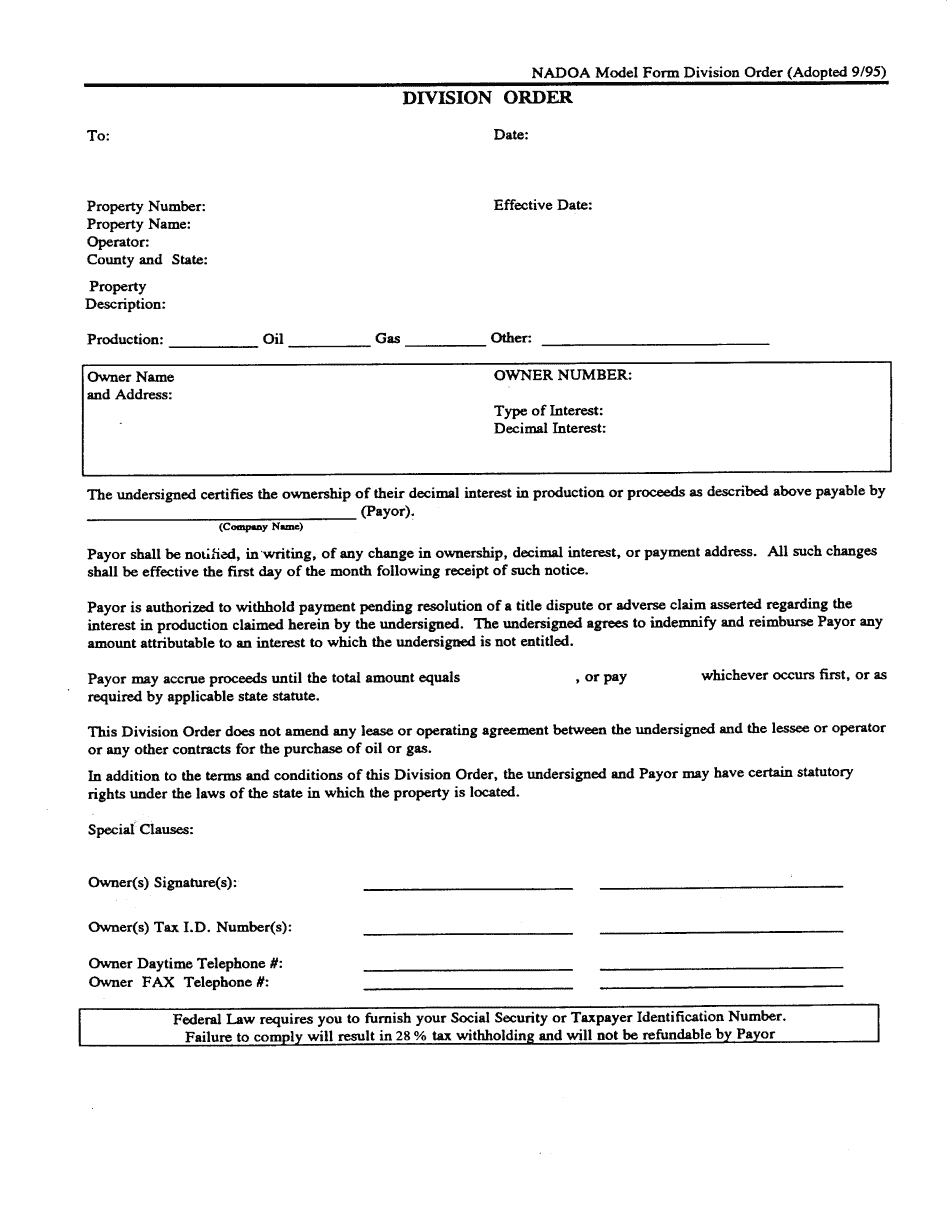

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Nadoa Model Form Division Order, steer clear of blunders along with furnish it in a timely manner:

How to complete any Nadoa Model Form Division Order online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Nadoa Model Form Division Order by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Nadoa Model Form Division Order from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Oil royalty inheritance