Hi everyone, today we're going to talk about mergers and acquisitions. We're gonna do the 101, sort of the intro level course, in five or six or ten minutes. We'll see where it goes. So, we're gonna talk about what it is, why people do it, who are the players in the space. Mergers and acquisitions 101 coming right up. But first, a couple of minutes about me. My name is Brett Sanctus. I am a business attorney and I am the start-up Shepherd. My law practice, which is most of what I do, I help clients with business matters. So, my clients are all businesses, they're never consumers. I help with capital raising, I help with contract drafting and negotiations, partner and founder structuring and disputes, and mergers and acquisitions. So, that's a good lead-in, let's get into it. So, M and a stand for merger and acquisition, and it's nothing more than companies buying and selling each other. So, company a wants to sell out, the owners of company a, they're tired of the business, they want to move on and sip cocktails on the beach forever. So, they go and find a buyer for the business. That's what falls under the umbrella of M&A. There are different types of deal structures. So, fundamentally, all these things I'll describe, all three of the main ones, are sales of businesses. But you could sell the assets of the business, which is a whole list of computers, desks, people, files, and records, and contracts, like boom, buyer buy it and you transfer all that stuff to the buyer, kind of individually. It's still ultimately the whole operation. People hear assets sale, they think it's just a piece of a business or something. It can be the whole thing, but it's done...

Award-winning PDF software

Chesapeake mergers and acquisitions Form: What You Should Know

Statement of changes in beneficial ownership of securities, Sep 26, 2017, Open Statement of changes in beneficial Chesapeake Energy and Wildfire Resource Development Corporation Stockholders. See Note 3, The Merger Agreement, dated Sep 24, 2017, The Merger Agreement, Form S-4/A in Schedule 13G to the Chesapeake Annual Report on Form 10-K for the fiscal period ended Nov 22, 2017. The “Offering” has completed on November 29, 2017, and the purchase price as of November 29, 2017, was 2,700,000,000. All outstanding shares of Common Stock and all the issued and outstanding shares of preferred stock were sold by the Company at discount from the opening price of 6.88 per share (the price at which the securities were sold to the Company on the day before the acquisition date). The excess of the net proceeds of the offering that were received over the aggregate purchase price of 2,700,000,000 is being used to repay all outstanding borrowings under the Credit Agreement, including those under the First Lien Facility, and to fund the increase in the outstanding principal amount of the second Lien Credit Facility. The Company is also using all of its cash to pay the 5 million accrued interest of the 75 million term loan of the First Lien Facility. See the borrowings in the Credit Agreement for further details. The Company is providing the unaudited interim financial statements to the investors and the Board of Directors. See the accompanying insights from the financial statements for more details. (1) Note 9, Chesapeake Energy Corporation Credit Agreement and Note 5, Chesapeake Energy Corporation Statement of operations for the year ended December 31, 2016. (2) Note 5, Chesapeake Energy Corporation Credit Agreement, Note 6, Chesapeake Energy Capital Structure and Note 14, Chesapeake Energy Corporation B-3 Table of Contents Chesapeake Energy E&P, Inc.

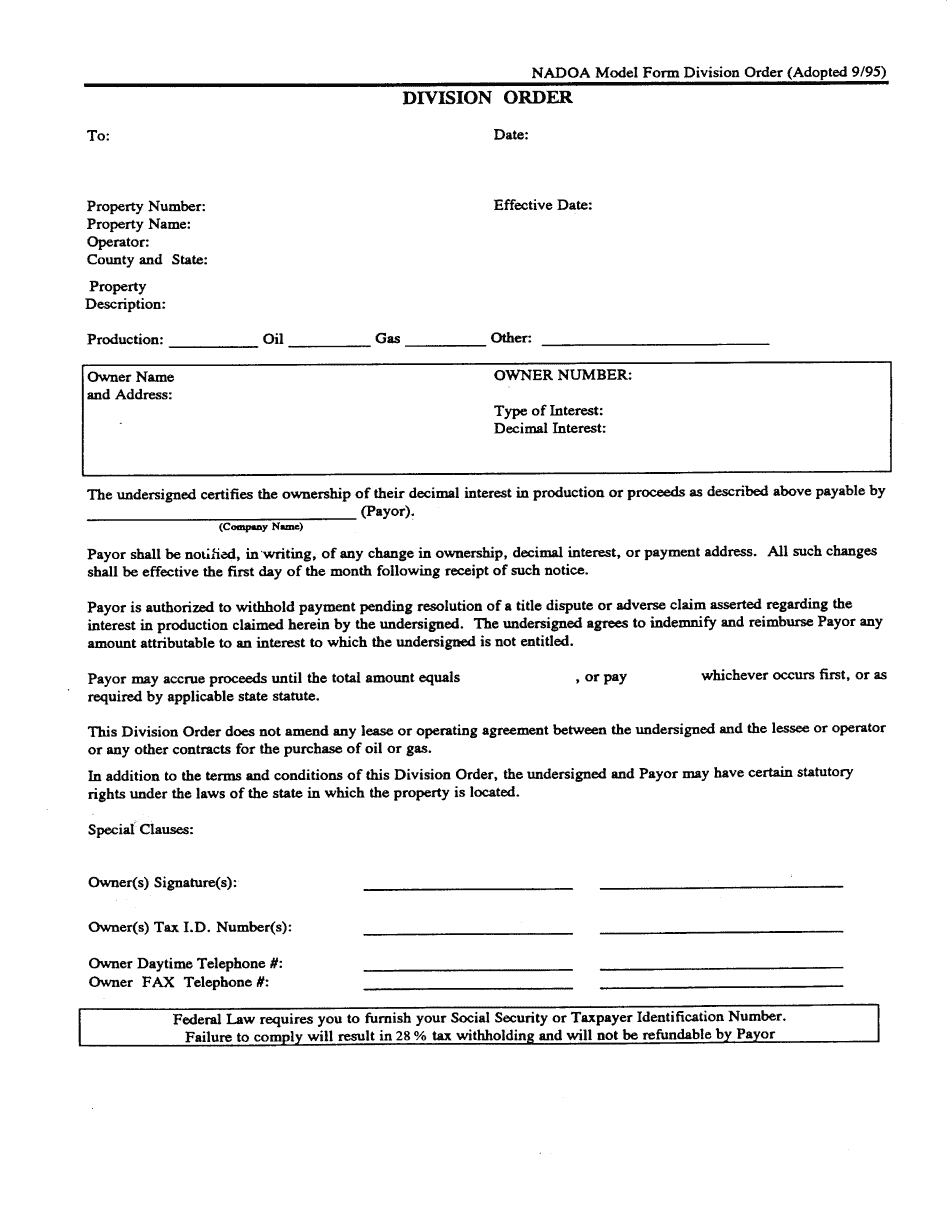

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Nadoa Model Form Division Order, steer clear of blunders along with furnish it in a timely manner:

How to complete any Nadoa Model Form Division Order online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Nadoa Model Form Division Order by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Nadoa Model Form Division Order from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Chesapeake mergers and acquisitions