Now, as we come to the close of 2018, it's time to look back and recount the existing deals and take stock of all the transactions that made a significant impact on the deal street. In terms of all parameters, 2018 has been a blockbuster year for the deal street. Deal values have crossed a whopping hundred billion dollars. Some predominant themes were the success of deals under the insolvency and bankruptcy court, particularly in the distressed asset space where deals worth about ten billion dollars have been made. Consolidation in many sectors and large global deals where multinational corporations have been competing fiercely have also been key themes. I have compiled a list of the top 10 deals, not in any particular order of preference. Here they are: 1. Horlicks received a boost by merging GSK healthcare with itself and Unilever. This helped Horlicks clinch the deal against Nestle. 2. Walmart acquired Flipkart for a whopping 16 billion dollars, marking a massive win in the new age sector of e-commerce and the convergence of ETL and retail. 3. Kumara Mangalam Birla took a leap of faith and Hindalco announced the acquisition of the global aluminium player Novelis for two and a half billion dollars, which is the largest acquisition by an Indian conglomerate overseas in recent times. 4. Aditya Birla Group's UltraTech fought a fierce battle against Ambuja Cements to acquire Binani Cement under the NCLT process, which has transformed the rules of the IBC game. 5. Tata Group also took advantage of the buying out of assets under the IBC process by acquiring Bhushan Steel. Additionally, Tata Steel announced a joint venture with ThyssenKrupp for its European operations. 6. In the financial services space, the biggest merger was between IDFC Bank and Capital First to create IDFC First Bank. 7. In the telecom sector, consolidation...

Award-winning PDF software

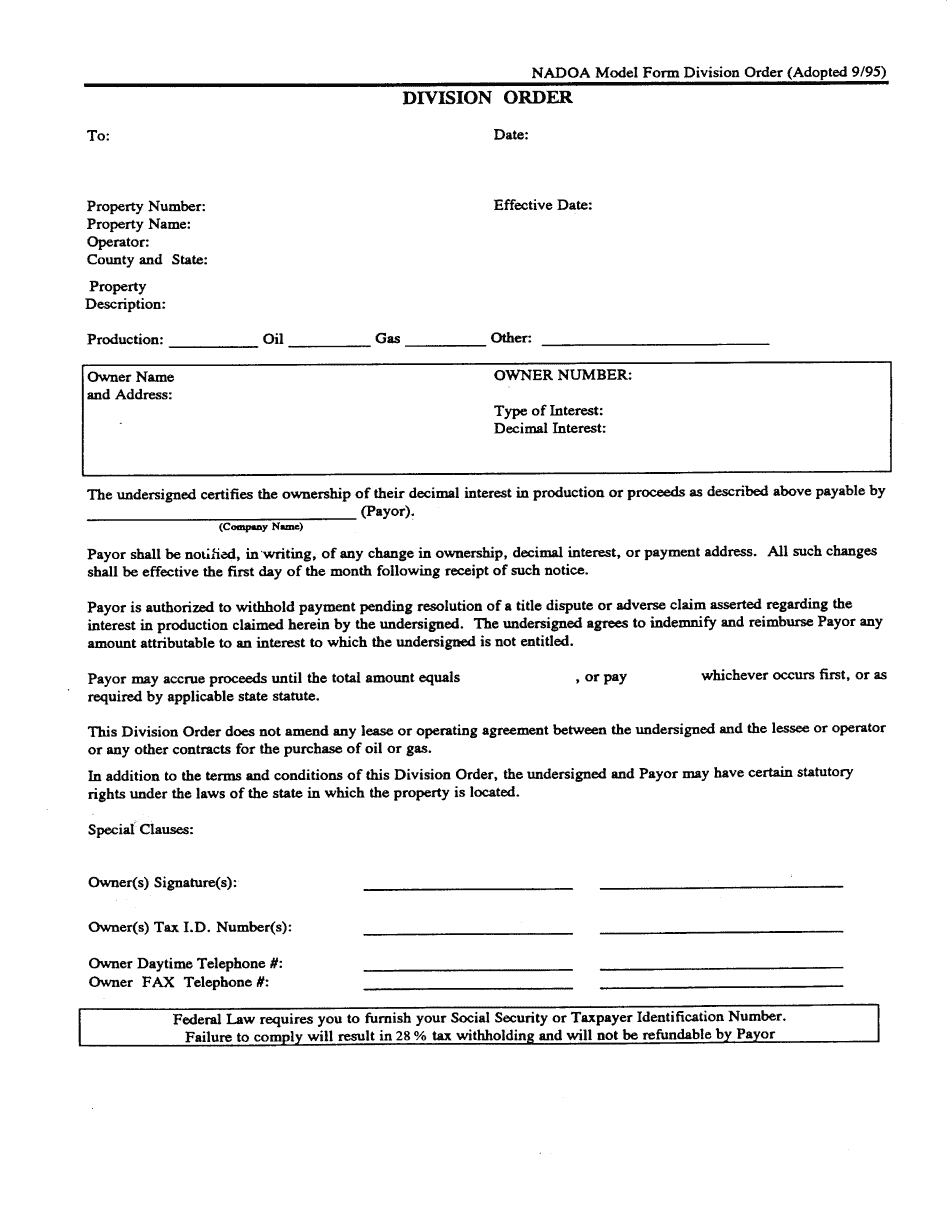

Nadoa mergers 2024 Form: What You Should Know

G., merger of a public company with a non-public company, merger of a partnership with a corporation). DRAFT NADIA Model Division Order 2024 — Fillable Blank Division-order-form.com · DRAFT NADIA Model Division Form Division Order 2024 — Fillable Blank Frequently Asked Questions Why don't you use any other model from The Society for Automotive Engineers? We have consulted the industry and other consultants in creating our own NADIA Model Form Division Order form. Why don't you have an online form? Many competitors are currently offering free-to-use online forms. We feel our NADIA Model Form Division Order is a different approach. Why don't you show the divisional order on the Divisional Register of Securities? The Divisional Register of Securities is an electronic database that tracks the status of stock offerings with the Securities Commissioner. This information is not specific to any particular type of transaction, making it a poor match to our Divisional Form Division Order Form. Why can't I access your forms on the web? Our Divisional Form Division Form does not have any form of access online. However, we have provided our forms to other companies to assist them in writing form questions. For a full list of other companies that have access to our form, please refer to the NADIA Directory. Where can I receive your forms? You can download your form from the NADIA Directory. You should not hesitate to use our NADIA Form Directory for Divisional Form Division Order form research. Who can I contact if I have any questions? For general questions about NADIA Model Form Division Order, or for licensing of our NADIA Form Division Order form for use in your organization, please use the following e-mail address: National Association of Division Order Analysts • • NASDAQ • 400 S Street • San Francisco • CA • 94104 Contact with NADIA is possible by contacting the National Sales Manager, NASDAQ. About the Author Chris A. Dean is Professor of Law and Business Law and Adjunct Associate Professor of Information Technology at the University of Tennessee College of Law.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Nadoa Model Form Division Order, steer clear of blunders along with furnish it in a timely manner:

How to complete any Nadoa Model Form Division Order online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Nadoa Model Form Division Order by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Nadoa Model Form Division Order from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Nadoa mergers 2024