Award-winning PDF software

Nadoa mergers Form: What You Should Know

Need guidance? Check out USPS.com's Customer Service page. You can also use the phone number and live chat service for online customer service. USPS — Use this to view important Postal Service notices, policies and information. Learn about fees, discounts and special offers. This page can be found online and is updated regularly. POP-UPS — Make a one-time delivery, online or at your local PO Box. Need extra P.O. Box addresses for a special event? Use the pop-up to create an extra PO Box address for a friend or family member. POP-UP — If an item is to be mailed to an address in the United States, or if you're outside the United States but want a specific person to pick the item up, or if the item cannot be delivered via normal USPS delivery methods. USPS Online Shipping Request Form (PDF) Form 1099-EZ, Electronic Deposit Form for Federal and Military Individuals This is a return of Form 1099-MISC filed by certain federal, state, county or municipal governments, or the Postal Service in response to a request for electronic payment of tax. Mail-in requests must be mailed to: U.S. Postal Service PO Box 29793, Austin, Texas 783 Online requests must be submitted using the following link : Form 1099-MISC (PDF) Form 1099-MISC — 1099-G — 1099-MISC — Forms for Individual, Business and Corporation Individuals — 1099-MISC-B — 1099-MISC-C — 1099-MISC — Forms for Public and Private Entities and Foreign Commercial Entities (PDF) Form 1099-MISC-B is a replacement for the Federal Form 1099-MISC, “Annual Report,” -Forms for Public and Private Entities and Foreign Commercial Entities (PDF) which is the Federal Form 1099-MISC. U.S. Treasury Form 1099-DIV — Form 1099-MISC Instructions Form 1099-DIV (PDF) will provide instructions for reporting the sale of securities for investment or other taxable purposes to report their sale in the previous year. This form could not be used to report the sale of tax-exempt securities.

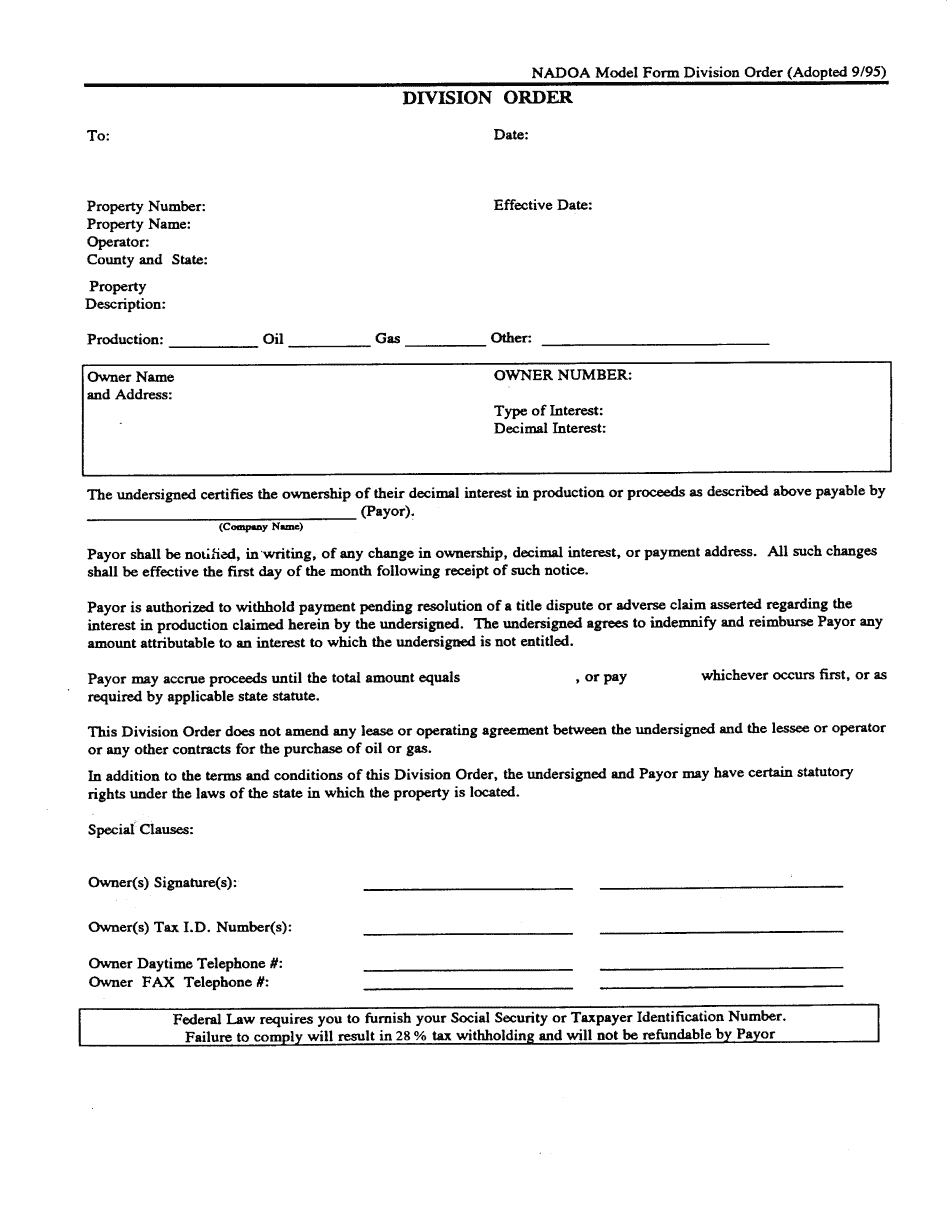

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Nadoa Model Form Division Order, steer clear of blunders along with furnish it in a timely manner:

How to complete any Nadoa Model Form Division Order online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Nadoa Model Form Division Order by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Nadoa Model Form Division Order from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.